Unlocking the wealth in your home while continuing to live in it—without monthly mortgage payments—may sound too good to be true. But for a growing number of Canadians aged 55 and older, reverse mortgages are doing just that.

As retirement evolves and traditional income sources are stretched thin, reverse mortgages are offering a financially empowering alternative. Whether you’re looking to supplement your income, reduce debt, or help your children enter the housing market, this tool is becoming a cornerstone of modern retirement strategy in Canada.

Let’s explore the six transformative benefits that a reverse mortgage can bring to your retirement lifestyle.

1. Access to Home Equity Without Selling

Your home is likely your largest financial asset, but tapping into its value traditionally meant selling or downsizing. With a reverse mortgage, you can access up to 55% of your home’s appraised value while continuing to live there. This unlocks immediate funds—tax-free—without disrupting your lifestyle or community ties.

Key Benefit: No need to uproot or sacrifice your comfort to gain liquidity.

2. No Monthly Mortgage Payments

This is the game-changer: unlike traditional loans, reverse mortgages require no monthly repayments. Repayment only happens when you move, sell, or pass away. That means more cash in your pocket each month, giving you the freedom to spend, save, or invest as you see fit.

Ideal for: Retirees living on fixed incomes who want financial breathing room.

3. Unmatched Flexibility in Spending

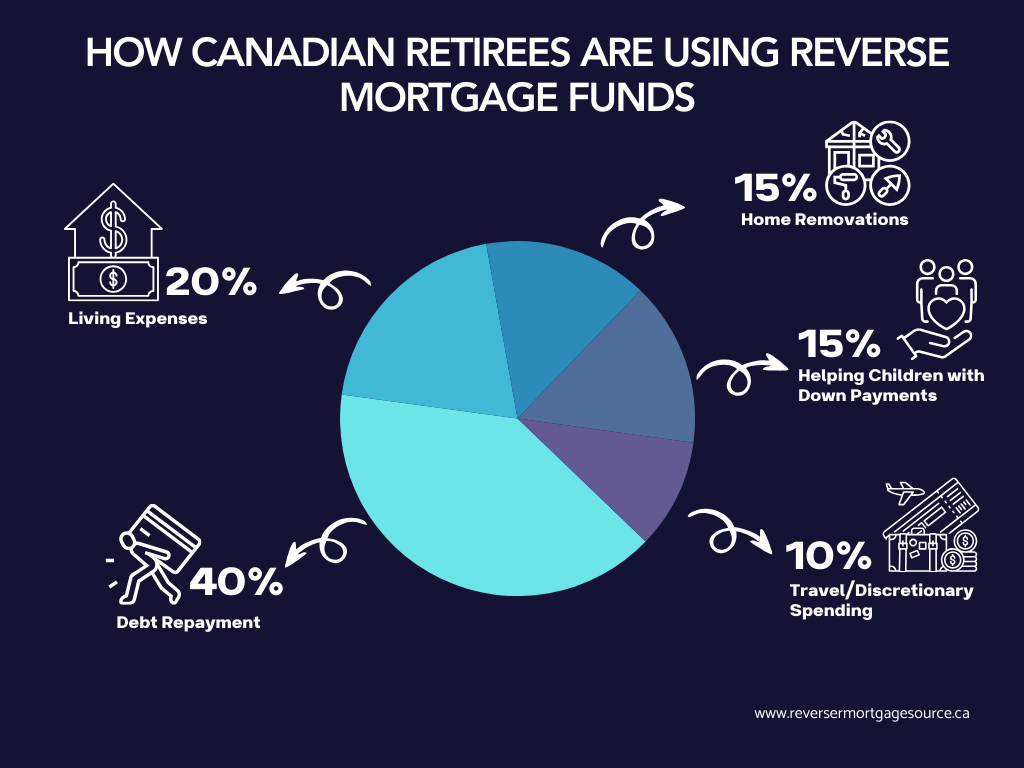

There are no restrictions on how you use your reverse mortgage funds. Use them to:

- Cover daily living expenses

- Pay off high-interest debts

- Renovate your home to age in place

- Travel, invest, or even help your children with a down payment

Reverse mortgages are a personalized solution, designed to fit your unique retirement goals.

4. Stay in Your Home Longer

The emotional and physical toll of moving can be overwhelming in later life. One of the biggest benefits of reverse mortgages is the ability to age in place. As long as you meet the terms of the loan—mainly staying current on property taxes, insurance, and maintenance—you can remain in your home for as long as you wish.

Peace of Mind: You don’t have to sacrifice your space to support your future.

5. Zero Risk of Default

Since you’re not required to make monthly payments, there’s no risk of default due to missed payments. This eliminates the financial pressure that can come with traditional mortgage obligations.

Bonus: This financial safety net helps protect against unforeseen income disruptions.

6. Protection Against Negative Equity

Worried about owing more than your home is worth? Canadian reverse mortgages come with built-in protection. With a no negative equity guarantee, you will never owe more than the fair market value of your home at the time of repayment, even if property values drop.

That means: Your estate won’t be burdened, and your loved ones have options.

In today’s financial climate, retirement isn’t one-size-fits-all, and neither is your home equity strategy. A reverse mortgage offers more than just cash; it offers control, comfort, and confidence.

If you’re 55 or older and own your home, it’s worth exploring whether a reverse mortgage could fit into your retirement plan. The equity you’ve built might be the key to unlocking the retirement lifestyle you’ve dreamed of, without sacrificing your home.