The money from a reverse mortgage is tax-free. You can use it for almost anything, such as:

Unlock Home Equity Without Selling Your Home

What Is a Reverse Mortgage?

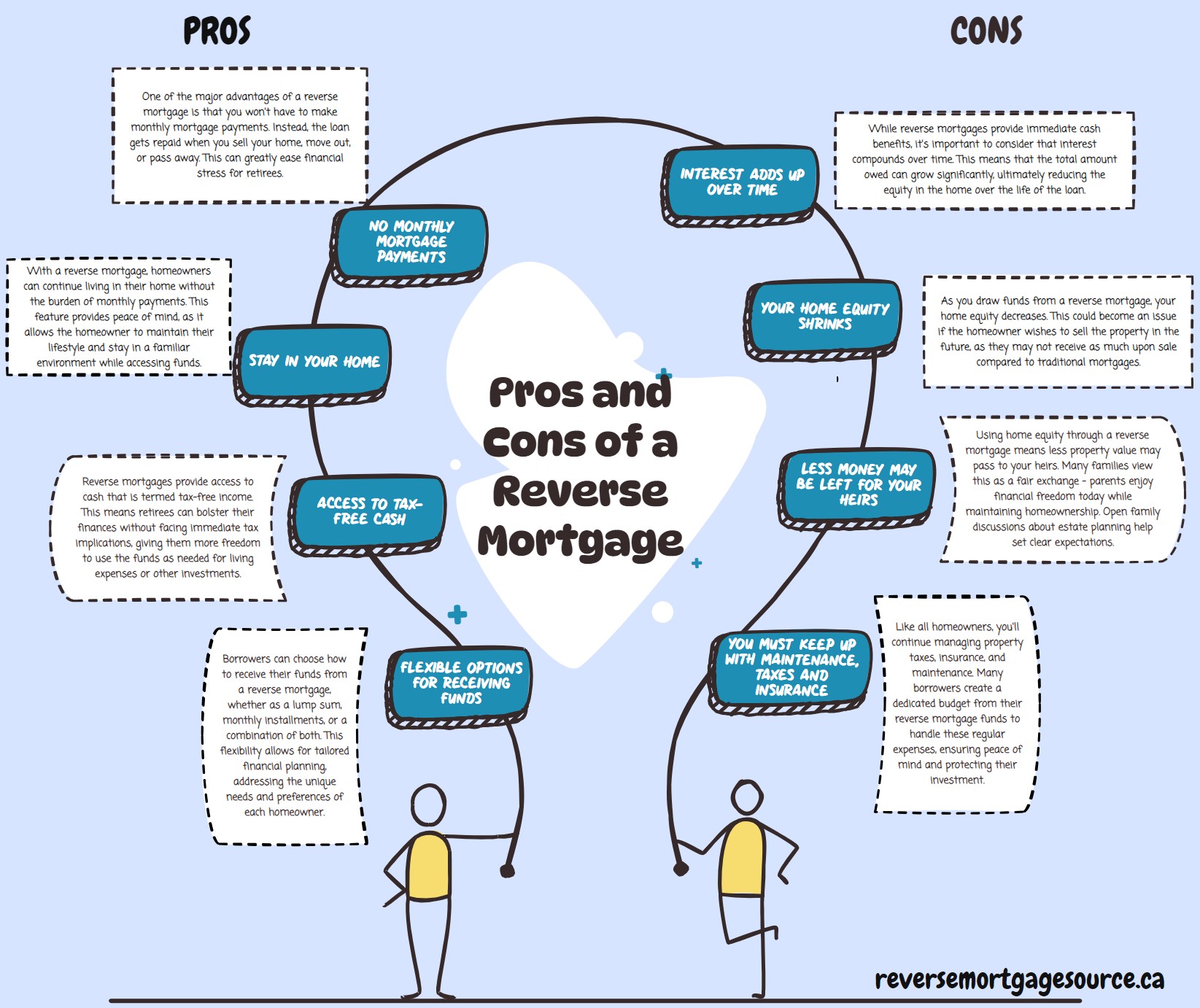

A reverse mortgage is a type of loan that lets you turn part of your home’s value into money you can use now. Unlike a regular mortgage, there are no monthly payments; you repay the loan only when you sell your home, move out permanently, or pass away.

The amount you can borrow depends on:

- Your age

- Your home’s value

- Where your home is located

- The type of property

The older you are, the more money you can usually access.

How Does a Reverse Mortgage Work in Canada?

With a reverse mortgage, you borrow money using your home as security, but instead of making payments each month, interest is added to the amount you owe. Over time, your loan grows, and your home equity goes down.

You still:

- Own your home

- Live in your home

- Pay for upkeep, property taxes, and insurance.

The loan is paid off when the home is sold or you no longer live there.

Who Should Consider a Reverse Mortgage?

A reverse mortgage might be a good fit if you:

- Are 55 or older

- Own your home (or have most of it paid off)

- Want to stay in your home as you age

- Need money for retirement, home repairs, debt, or healthcare

- Don’t want monthly payments or to sell your home

It’s not for everyone. It’s important to look at all your options first. A reverse mortgage can impact your estate, inheritance plans, and future housing choices.

How Can You Use the Money?

- Covering everyday costs

- Paying off debts or credit cards

- Making home improvements

- Helping family members

- Paying for care or medical costs

There are no rules about how you use it; the money is yours!

Is a Reverse Mortgage Safe?

In Canada, reverse mortgages are regulated. You can never owe more than what your home is worth when it’s sold. That’s called a “no negative equity guarantee.” Your estate will never have to pay out of pocket beyond the home’s value.

Still, it’s vital to work with a mortgage advisor who can walk you through how it all works, explain fees, and help you decide if it fits your situation.

How to Get a Reverse Mortgage

Getting a reverse mortgage starts with a conversation. Here’s a basic rundown of the steps:

- Reach out to speak with a licensed mortgage professional at The Financing Factory

- Find out how much you can borrow

- Talk through your goals and make sure it’s the right fit

- Review and sign legal documents

- Receive your funds

You don’t need to navigate this alone. At The Financing Factory, we help you understand the process from start to finish.

Why Work With The Reverse Mortgage Source brought to you by The Financing Factory?

We focus only on reverse mortgage information for Canadians. Our goal is to provide clear answers and honest guidance. We don’t sell loans. We’re here to help you make informed choices with confidence.

When you’re ready to explore further, The Financing Factory can connect you with licensed professionals who offer tailored advice based on your unique needs.