Canadian homeowners are rewriting the rules of retirement. With mortgage debt rising among retirees and traditional savings stretched thin, many are turning to reverse mortgages as a smart, strategic way to stay financially strong — and stay in their homes longer.

If you’re 55 or older and looking for debt relief, income flexibility, or ways to support your children, understanding reverse mortgages in Canada could be your first step toward a more secure future.

Why More Older Canadians Are Taking On Mortgage Debt

Recent data from Statistics Canada reveals an unexpected trend: Canadians aged 55 and up are carrying more mortgage debt than ever. Households aged 55 to 64 saw a 6.5% increase, while those 65+ saw a 6.4% rise in mortgage debt over the past year.

Meanwhile, younger generations — many priced out of the housing market or selling under pressure from high interest rates — are reducing their mortgage balances. This shifting dynamic has led many older homeowners to tap into their home equity to address growing financial needs.

Whether it’s due to rising living costs, inflation, healthcare expenses, or helping children enter the housing market, reverse mortgages are quickly becoming a financial lifeline.

What Is a Reverse Mortgage and How Does It Work in Canada?

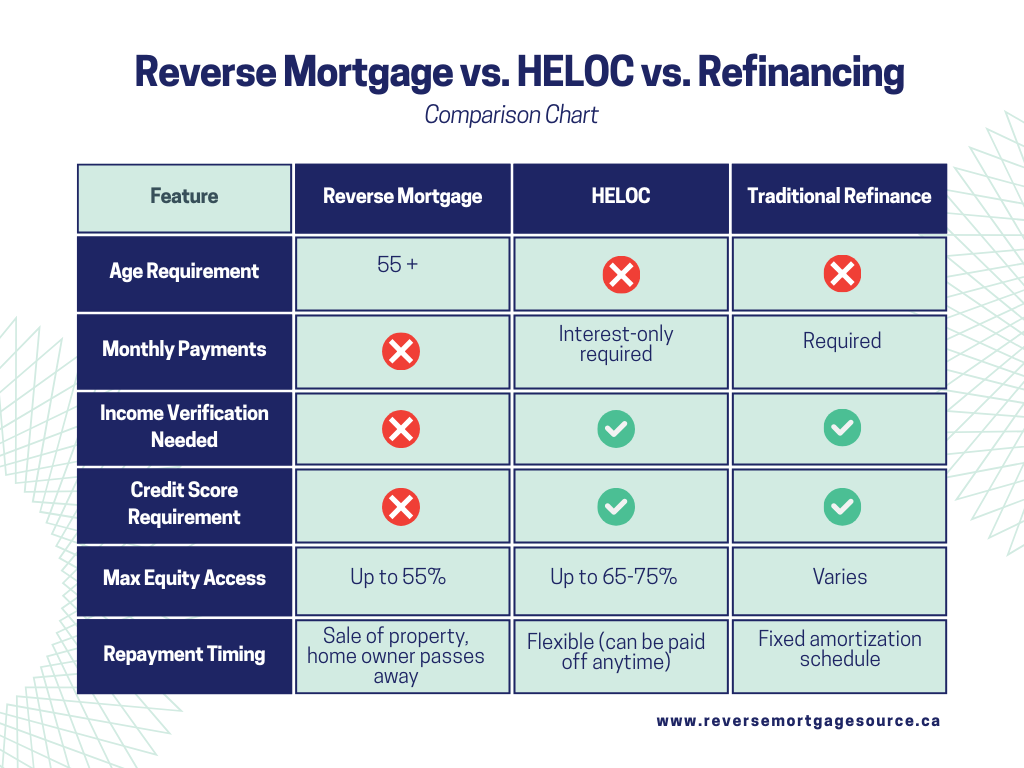

A reverse mortgage is a loan that lets homeowners aged 55 or older borrow up to 55% of their home’s equity. The funds are tax-free, require no monthly payments, and don’t impact eligibility for government benefits like Old Age Security (OAS) or the Guaranteed Income Supplement (GIS).

You remain the owner of your home, and repayment isn’t required until you sell, move out, or pass away. At that point, your home is sold and the loan is repaid from the proceeds.

Here’s the key condition: If you have an existing mortgage, the reverse mortgage must be used to pay it off first, making the lender the primary lien holder.

Why Are Reverse Mortgages Growing in Popularity?

The numbers speak volumes:

- As of August 2024, over $8.5 billion in reverse mortgage debt is outstanding — an 18% year-over-year increase.

- Reverse mortgage lenders are reporting an average 34% increase in reverse mortgage business

Here’s why:

Debt Consolidation and Relief

Many retirees are using reverse mortgages to pay off existing mortgages or other debts, especially as interest rate renewals spike. With traditional mortgage rates around 4% and reverse mortgage rates averaging 7% right about now, some may balk at the cost, but for those without income flexibility, no monthly payments can be a game-changer.

Gifting and Intergenerational Wealth Transfer

More homeowners are using reverse mortgages to help their children with down payments. In regions like North Vancouver and the GTA, where homes are valued well above $1 million, reverse mortgages allow parents to unlock equity and give $100,000 or more without selling their home or facing tax implications.

According to HomeEquity Bank, 16% more Canadians are now using reverse mortgages for gifting than in previous years.

Aging in Place with Dignity

Downsizing used to be the norm. Today, it often doesn’t make financial sense – smaller homes aren’t necessarily cheaper, and moving comes with emotional and logistical costs. With a reverse mortgage, retirees can stay in the home they love while accessing the equity they’ve built over decades.

The Benefits of Reverse Mortgages for Canadian Retirees

- No Monthly Payments: Frees up cash flow to cover other expenses.

- Tax-Free Cash: Use funds for renovations, travel, caregiving, or gifts.

- Stay in Your Home: Maintain your lifestyle and community ties.

- No Impact on OAS or GIS: Keep your government benefits intact.

- Control Over Your Equity: Use what you need, when you need it.

What About the Risks? Let’s Talk Transparency

Yes, reverse mortgages come with higher interest rates than traditional mortgages, and the debt compounds over time. That means you may leave less to your heirs, however, Canadian regulations are designed to protect borrowers. You can never owe more than your home’s fair market value, even if property prices fall. And your heirs will always have options: pay off the loan, sell the property, or transfer it to the lender.

It’s not the right fit for everyone — but for the right person, it can be a powerful, low-stress financial tool.

Secure Your Retirement — Your Way

Reverse mortgages in Canada are more than a financial product — they’re a strategy for stability, generosity, and peace of mind.

You’ve worked hard to build equity in your home. Now it’s time to let that equity work for you.

If you’re ready to explore your options, or even just curious how a reverse mortgage could fit into your retirement plan, reach out to the team at The Financing Factory. We’re here to guide you — with integrity, clarity, and a plan tailored to your future.

Take the next step today — your home’s equity could be the key to your most empowered years yet.