Retirement today isn’t about slowing down — it’s about living with purpose, passion, and possibility. For many Canadians aged 55 and older, retirement is becoming a launchpad to work abroad, live globally, and reinvent life on their own terms.

Enter the Silver Digital Nomad: mature professionals or self-employed Canadians who use their skills remotely while embracing the freedom of global living.

But how do you fund such a lifestyle without dipping into your retirement savings or selling your home?

Here’s the answer you didn’t expect — a reverse mortgage.

The New Face of Retirement: Digital, Global, Limitless

The idea of sipping espresso in a Lisbon café while replying to clients in Canada or consulting for businesses from a beachfront Airbnb in Bali isn’t just for millennials anymore. More and more Canadians aged 55+ are discovering they can travel, work, and live abroad full-time, thanks to:

- Decades of experience and credibility in their industry

- Location-independent businesses or consulting practices

- A desire for adventure, inspiration, and cultural enrichment

But what makes the leap from homeowner to digital nomad truly sustainable? Cash flow and housing flexibility — both of which a reverse mortgage can offer.

What’s a Reverse Mortgage & Why Should a Digital Nomad Care?

A reverse mortgage allows Canadian homeowners aged 55 and older to borrow up to 55% of their home’s value, tax-free, without monthly payments. The loan is only repaid when you sell, move out permanently, or pass away.

It’s not just a loan. It’s a way to turn your home equity into lifestyle funding, while keeping your home as a base or income property.

Imagine This:

You unlock $300,000 from your mortgage-free home in Vancouver. You keep the house (maybe even rent it out). You use that equity to:

- Pay for extended stays in Portugal, Costa Rica, or Vietnam

- Cover international health insurance and travel costs

- Invest in growing your consulting or online business

- Enjoy a more comfortable and meaningful nomadic lifestyle

Why Reverse Mortgages Make Sense for Silver Digital Nomads

Who Is This For? The Ideal Silver Nomad Profile

You might be the perfect fit for this lifestyle if:

If this sounds like you, you’re not alone. Thousands of Canadians are taking their skills — and their equity — abroad!

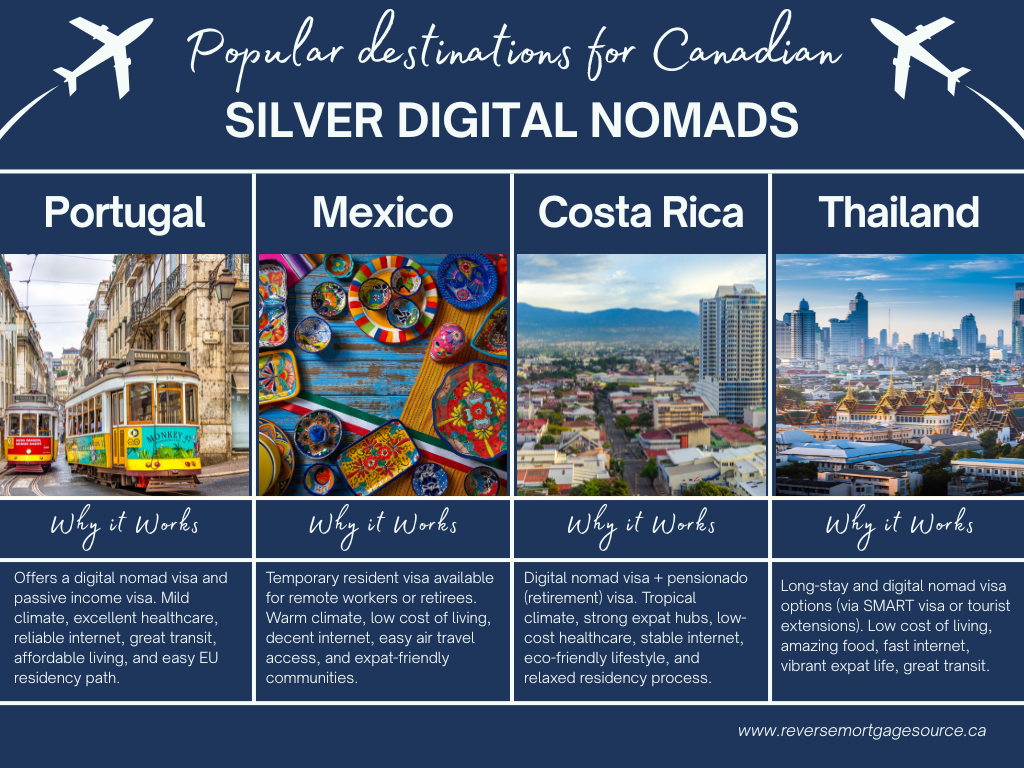

Real Possibilities: Where Are Canadian Silver Nomads Going?

But…What About the Risks?

Let’s be honest — every financial decision has its trade-offs.

But for many, the freedom, fulfillment, and flexibility gained far outweigh the potential drawbacks, especially when you have no monthly payments and the freedom to live where you want.

Your Next Adventure Starts Here

You’ve spent your life building a home, a career, and financial security. Now it’s time to let that security unlock new horizons.

Whether you’re dreaming of a long-term stay in Europe, a beachfront home office in Asia, or simply a more inspiring way to semi-retire, a reverse mortgage can help fund your next chapter, without compromise.

Ready to Redefine Retirement? Let’s Talk

At The Financing Factory, we don’t just help you unlock home equity — we help you unlock what’s possible. From tailored reverse mortgage solutions to guidance on becoming a global silver digital nomad, our team is here to help you build the life you deserve, wherever in the world that may be.